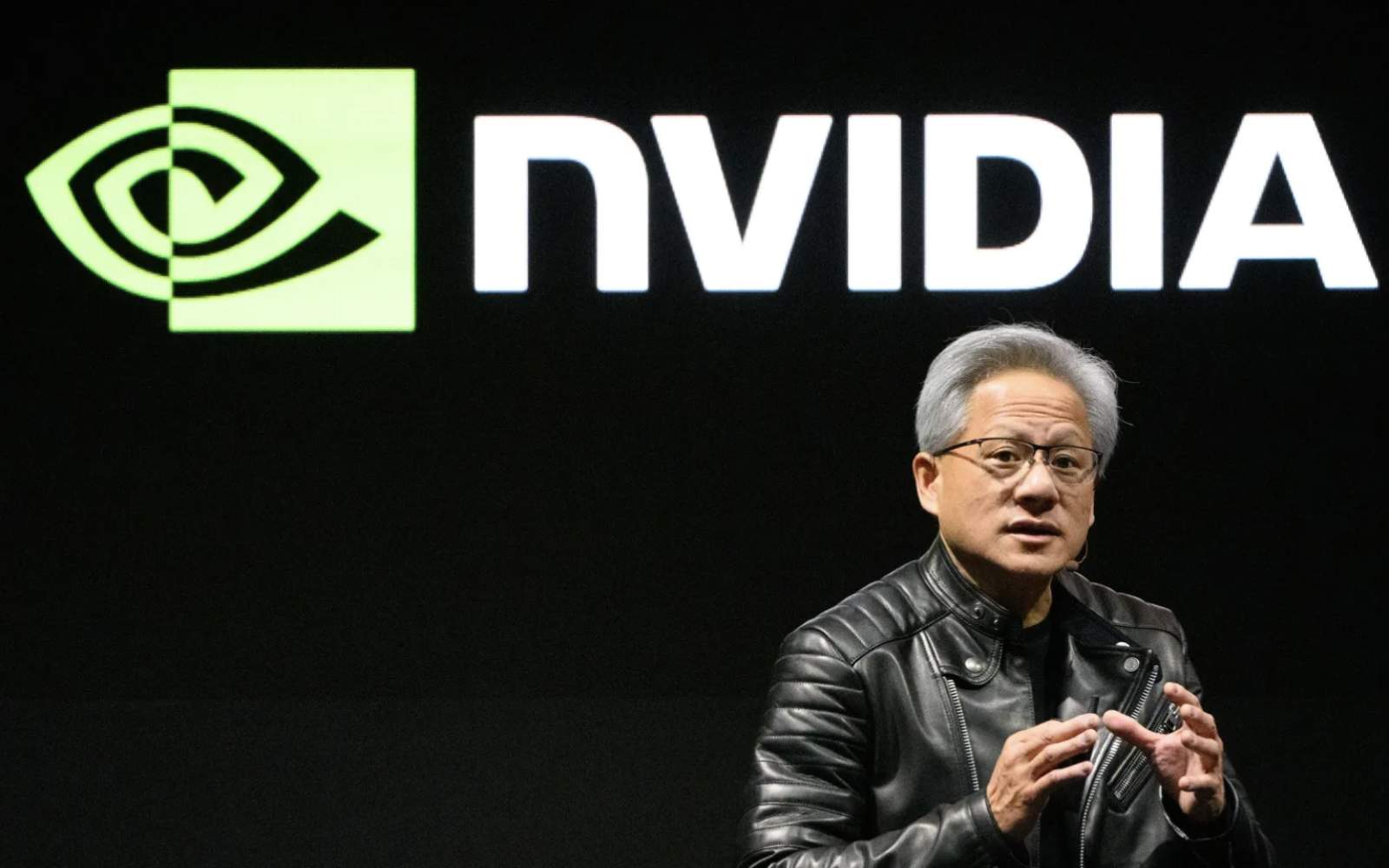

Nvidia's Endgame: A Fundamental Analysis of Its Next Act

Nvidia's story is often told as a triumphant conquest of the AI hardware market, a narrative of unprecedented growth and technological supremacy. But for a company that has reached the summit, the most critical phase is not celebration, but consolidation and expansion. The true endgame is not just about selling more powerful chips. A deep fundamental analysis, visually detailed in this video breakdown, reveals the financial fortress that empowers Nvidia to pursue a much grander vision: building the indispensable, full-stack utility for the entire AI economy. Understanding this next chapter is key to grasping the company's long-term trajectory.

Act One is Over: The Limits of Hardware Supremacy

Winning the hardware war is an incredible achievement, making Nvidia’s GPUs the foundational tools of the current AI gold rush. However, a rigorous fundamental analysis must acknowledge the historical precedents in the tech industry. Even the most dominant hardware—from IBM’s mainframes to Intel's early x86 CPUs—eventually faces the gravitational pull of commoditization. Competitors catch up, alternatives emerge, and price becomes a more significant factor.

Nvidia's leadership is well aware that long-term, unassailable market power is rarely sustained through hardware alone. The most enduring tech empires are built on software, ecosystems, and services that create deep customer lock-in. This is the strategic pivot we are now witnessing. The story is no longer just about the "shovels"; it's about owning the railroad, the bank, and the entire operating system of the mining town.

The Next Frontier: From Silicon to Subscription

The most crucial element of Nvidia's evolving strategy is its aggressive push "up the stack" into enterprise software and services. The CUDA platform was the first step, creating a generation of developers fluent in Nvidia’s programming language. The next, more lucrative step is to package this power into a subscription-based model with NVIDIA AI Enterprise (N-AIE).

Think of N-AIE as the "Microsoft Office" or "Adobe Creative Cloud" for artificial intelligence. It's a suite of optimized, supported, and secure software that allows large corporations to deploy AI without the immense headache of managing open-source components. This shifts the revenue model from a one-time, transactional hardware sale to a predictable, recurring software subscription—a transition that any deep fundamental analysis would identify as a powerful driver of long-term value and margin expansion.

A Declaration of Intent: Becoming an AI Cloud Power

Perhaps the boldest illustration of Nvidia's ambition is its direct entry into the cloud computing market with offerings like DGX Cloud. For years, Nvidia's primary customers have been the cloud "hyperscalers" like Amazon Web Services, Microsoft Azure, and Google Cloud. Now, Nvidia is offering its own specialized cloud service, allowing businesses to rent access to its cutting-edge AI supercomputers directly.

This is a high-stakes declaration of intent. It signals that Nvidia is no longer content to be a mere component supplier to the cloud giants; it aims to be a cloud provider in its own right. This move opens up a massive new addressable market and positions the company to capture a larger slice of the value it helps create. A complete fundamental analysis must view this not just as a new product, but as a strategic challenge to the established cloud hierarchy.

The Endgame: Building an Integrated and Indispensable AI Utility

When you connect these strategic pillars—dominant hardware, a proprietary software ecosystem, a recurring subscription model, and a direct cloud offering—the endgame becomes clear. Nvidia’s goal is to become the world’s first fully integrated AI utility. It aims to be the one-stop shop for any enterprise looking to leverage artificial intelligence, providing every necessary layer of the stack.

This vision of a seamless, end-to-end platform is the ultimate competitive moat. It makes the idea of switching to a competitor's hardware or software not just difficult, but strategically nonsensical due to the loss of integration and optimization. This explains the prediction in the source video: a major software acquisition in the enterprise space would be a logical next step to accelerate this endgame and cement its platform as the irreplaceable standard.

Summary: The Financial Power Behind the Vision

Nvidia is executing a monumental pivot from a hardware titan to a full-stack AI platform powerhouse. This is a capital-intensive, high-risk, and incredibly ambitious strategy that involves competing with its own customers and defining new markets. Such a grand vision would be pure fantasy without an almost impenetrable financial foundation to support it.

The company's massive strategic investments and ability to withstand geopolitical shocks are only possible because of its "unsinkable balance sheet." Before you can fully appreciate the potential of this future empire, you must understand the strength of its current foundation. To see that strength laid bare, watch the full video for a compelling visual fundamental analysis of the financial metrics that give Nvidia the power to build tomorrow.

![]() Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Comments