Nvidia: A National Asset in the Global Chip War

In today's interconnected world, the most significant corporate battles are no longer confined to boardrooms or market floors; they are fought on the geopolitical chessboard. For a company like Nvidia, its strategy is as much an exercise in international relations as it is in technological innovation. While many analysts get lost in the noise of daily stock movements, a deeper understanding reveals a company navigating the turbulent waters of techno-nationalism. The headline-grabbing financial metrics, such as the apparent fundamental analysis of Nvidia’s, often mask these larger, more powerful geopolitical currents shaping its future.

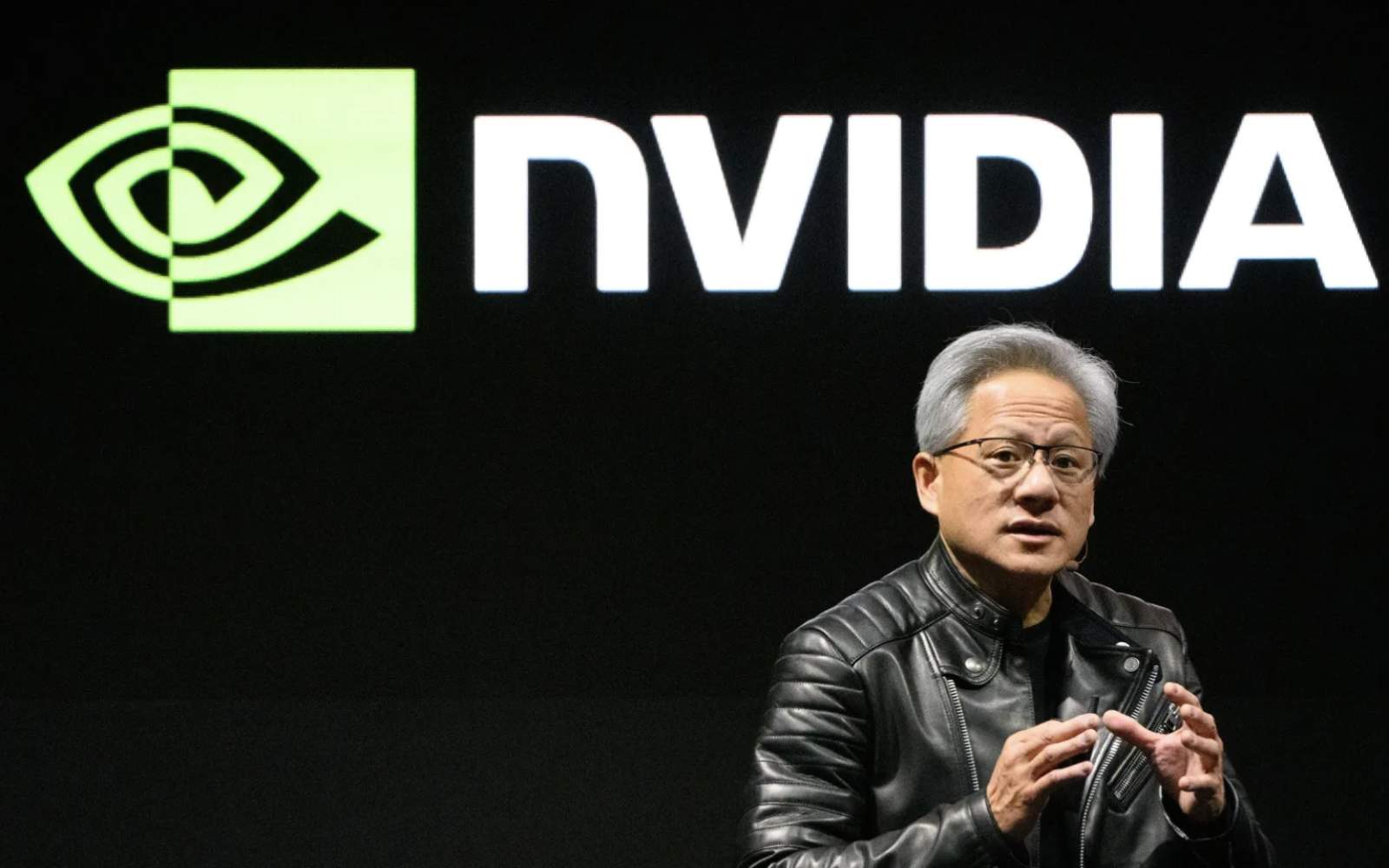

Foto:pexels.com

Foto:pexels.comSemiconductors: The New Frontier of Global Power

For decades, oil was the world's most critical strategic resource, defining alliances and sparking conflicts. Today, that title arguably belongs to advanced semiconductors. These tiny silicon marvels are the bedrock of the modern economy, powering everything from consumer smartphones and AI data centers to sophisticated military guidance systems and critical infrastructure. The nation that controls the design and production of these chips holds a decisive economic and security advantage.

This reality has ignited a fierce "chip war," primarily between the United States and China, with each superpower vying for technological supremacy. Government policies like the CHIPS and Science Act in the U.S. are not mere economic stimulus; they are declarations of strategic intent. In this high-stakes game, Nvidia is not just a participant; its advanced AI chips represent the crown jewels of Western technological leadership.

The China Dilemma: A Strategic Retreat, Not a Defeat

Viewed through a purely financial lens, the collapse of Nvidia's advanced AI chip market in China from a 95% share to zero seems like an unmitigated disaster. The source article rightfully identifies this as the "China Black Hole," a massive loss of revenue. However, viewing this event through a geopolitical framework reframes it as a painful but necessary strategic retreat. Continuing its deep entanglement with a primary geopolitical rival was becoming an existential risk.

U.S. export controls were the mechanism, but the underlying cause was a fundamental misalignment of national interests. For a company so integral to America's AI leadership, heavy reliance on a market controlled by a strategic competitor was untenable. This "de-risking" was not a sign of operational failure but a forced alignment with a new global reality. It was a conscious choice to trade a lucrative but volatile market for a more secure, albeit different, future.

Pivoting Home: Fortifying the Domestic Arsenal

Nvidia's response to the loss of the China market was not to retrench, but to redeploy its immense resources. Moves that seem baffling to a business analyst, such as investing in a direct competitor like Intel, make perfect sense for a grand strategist. This is not about propping up a rival; it's about contributing to a robust and resilient domestic semiconductor ecosystem. It is a declaration that the security of the home-front supply chain is now a paramount priority.

By investing in a U.S.-based manufacturing ecosystem, Nvidia helps onshore its "arsenal" of critical technology. This strategic pivot transforms a geopolitical vulnerability into a fortified position. The company consciously trades the risks of international political whims for the stability and support of its home government, positioning itself to be a primary beneficiary of national industrial policy and subsidies. This isn't just defense; it's a calculated offensive move to secure long-term dominance.

The War Chest: The Financial Power to Play Geopolitics

A company cannot make multi-billion-dollar geopolitical pivots without an exceptionally strong financial foundation. This is where Nvidia's strategy and its financials intersect. The massive "cash burn" that alarms many short-term observers is, in this context, the cost of waging a strategic campaign. It's the capital required to abandon one theater of operations and establish a new, more secure one.

Only a company with an 'unsinkable balance sheet,' as the source material describes it, can afford such bold maneuvers. An extremely high Altman Z-Score, a measure of financial health, is not just a nice-to-have metric; it's the permission slip to be geopolitically ambitious. It represents the "war chest" that allows Nvidia to absorb the shock of losing a major market and simultaneously invest heavily in building its future on more stable ground. Without this financial fortress, the story would be one of crisis, not strategic redeployment.

Conclusion: A Company Forged in Geopolitical Fires

To analyze Nvidia solely on its P/E ratio or quarterly cash flow is to miss the most important story. The company is a primary actor in a global struggle for technological supremacy, and its actions must be interpreted through that lens. The painful decoupling from China and the aggressive pivot toward a domestic supply chain are not signs of a business in turmoil, but of a strategic asset adapting to a new world order.

Nvidia is trading short-term certainty for long-term strategic security and alignment with powerful national interests. This geopolitical framing brings clarity to moves that otherwise seem contradictory. It shows a company playing a long game where the ultimate prize is not just market share, but a foundational role in the future of technology and global power.

Of course, such a grand strategy is only viable if the company's financial core is solid as bedrock. To truly appreciate the astonishing financial health that enables these geopolitical gambles, you must look at the numbers. Explore the detailed analysis of Nvidia's financials to understand the fortress-like balance sheet that makes it all possible.

![]() Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Comments